Company: Liiva.ch

Industry: Fintech

From 9% to 38.0% PMF in Six Months

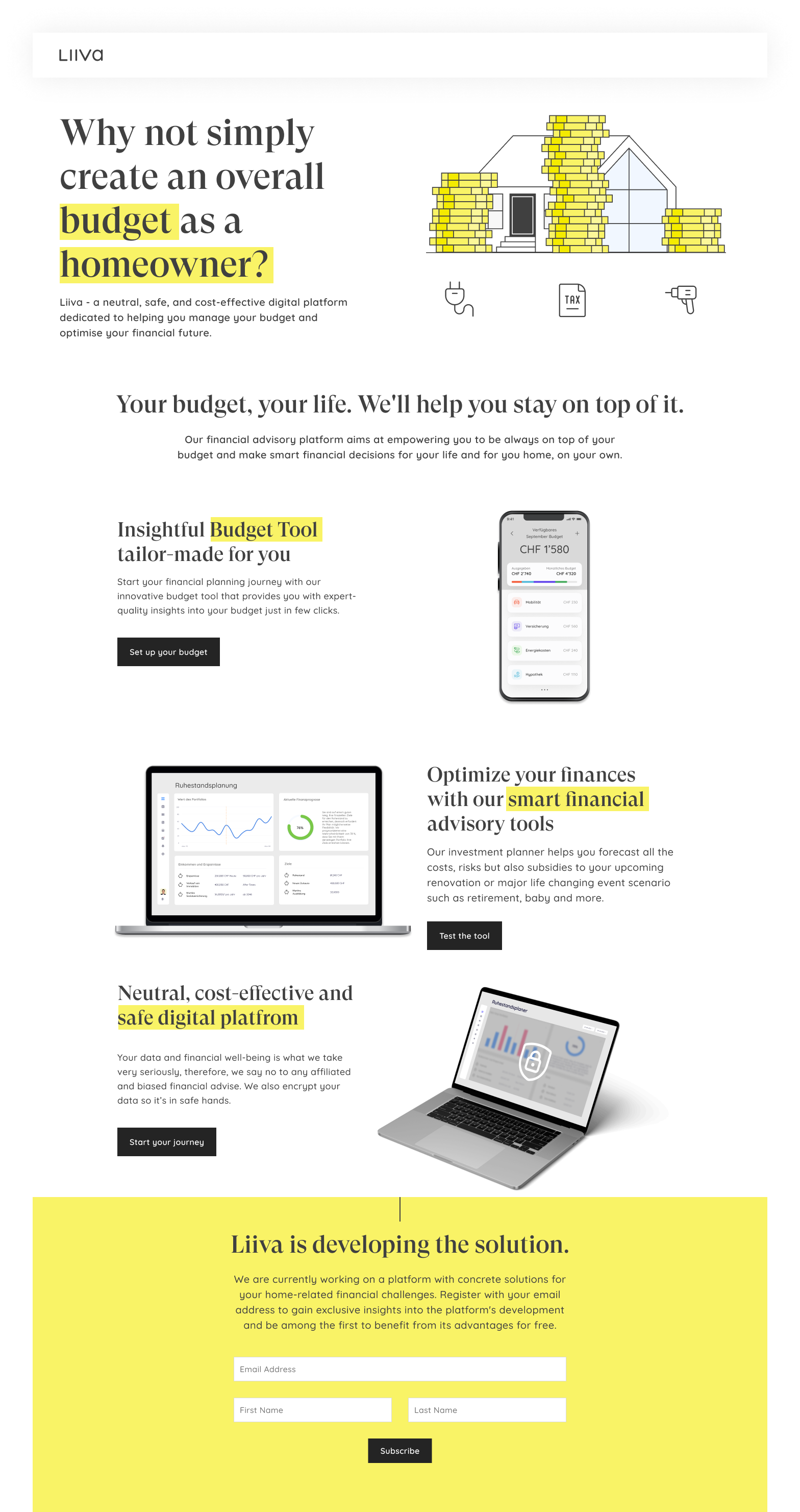

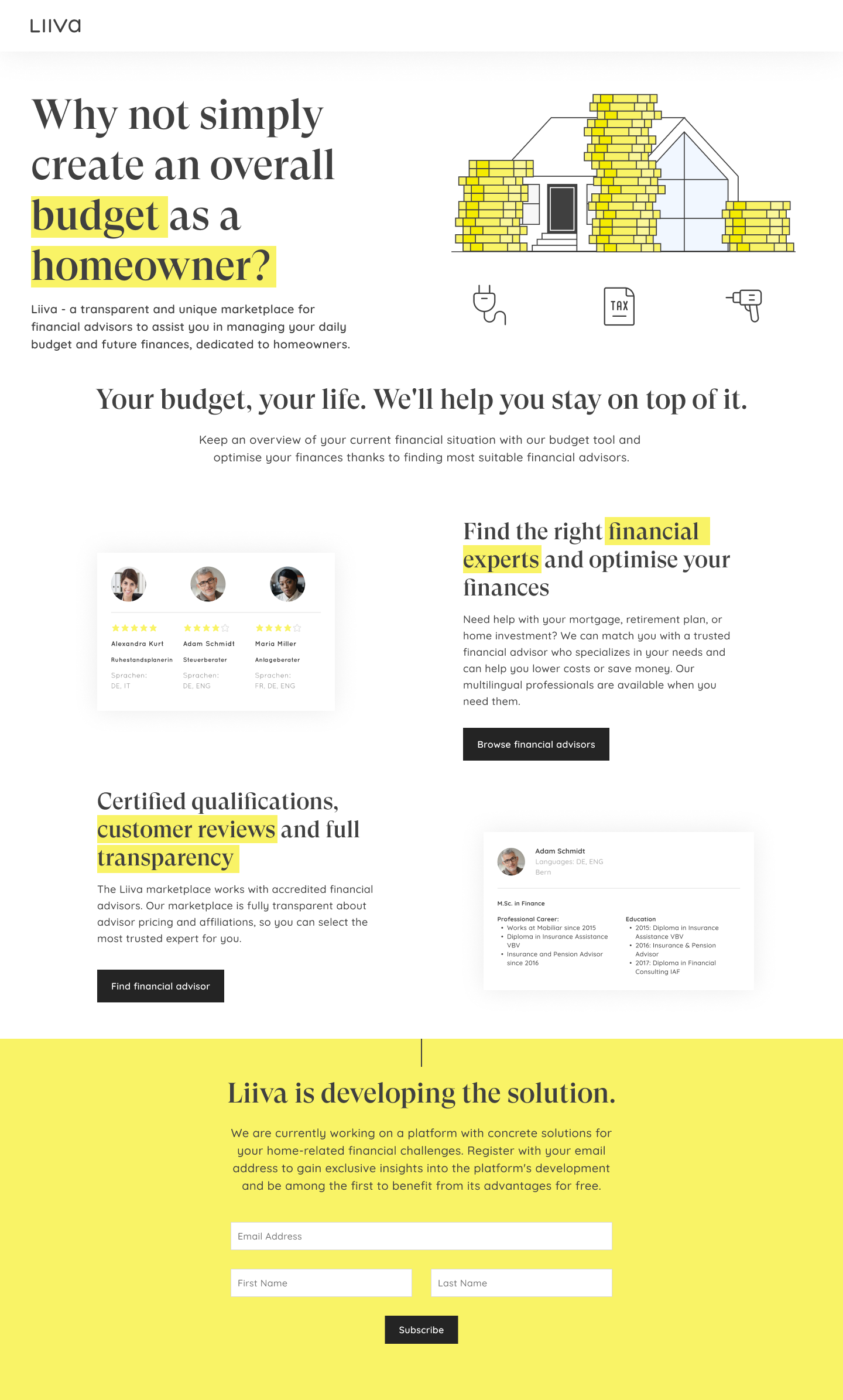

The first version of Liiva—a digital platform built to empower individuals in residential property search, management, and sales—faced a market failure, recording a low 9% Product-Market Fit (PMF) score. To survive, the business pivoted to become a Digital Financial Advisor, setting the core objective: Validate or refute our target group and value proposition.

The first version of Liiva, a digital platform built to empower private individuals in residential property search, management, and sales, faced i market failure, recording a low 9% Product-Market Fit (PMF) score. To survive, the business pivoted to become a Digital Financial Advisor, setting the core objective: "Validate/Refute our target group and value proposition.

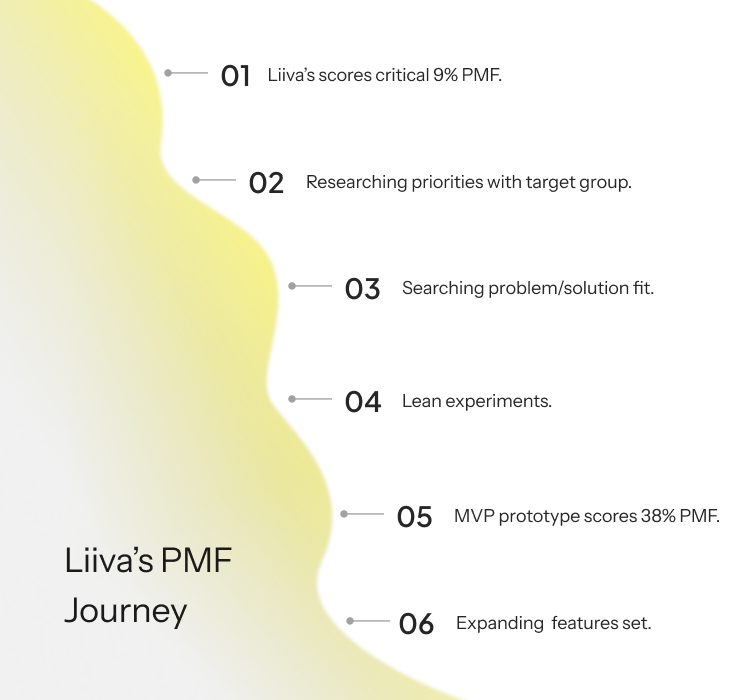

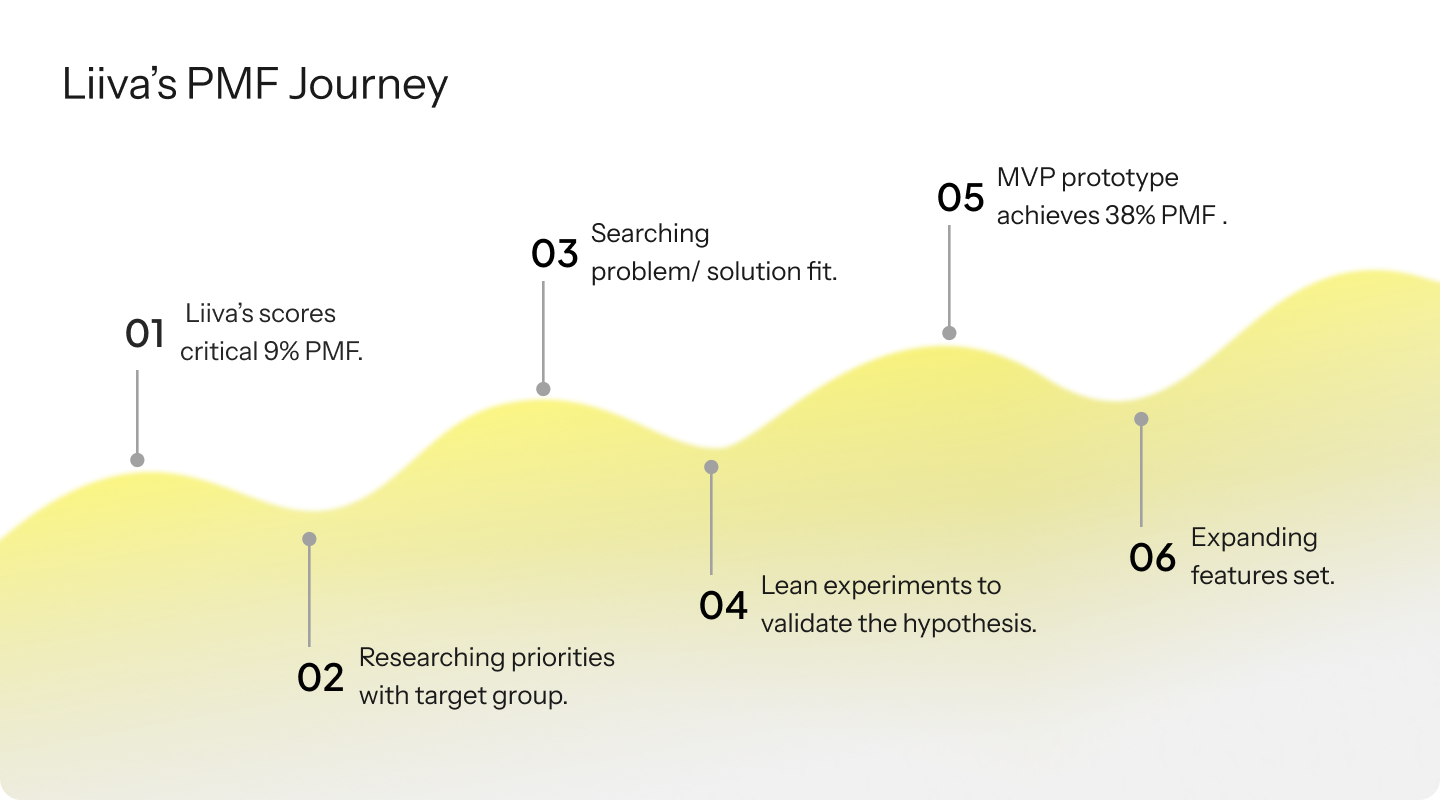

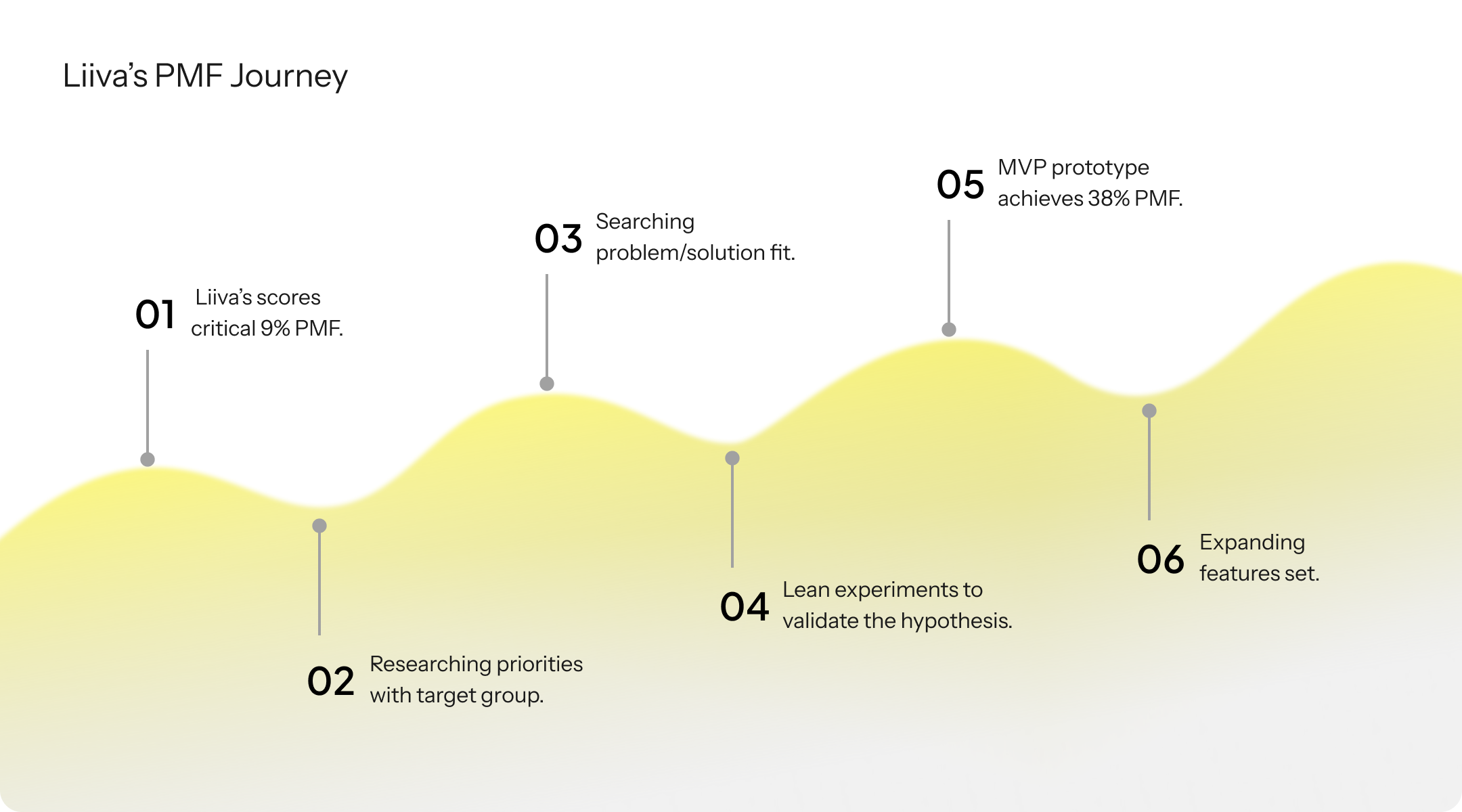

The PMF Journey

With such high stakes, our phase-gated process was vital. It stopped us from chasing unvalidated ideas and prevented sunk costs by requiring concrete user proof at every stage of the pivot.

Lean experiments & research

23

Experiments

15

Prototypes

50

Interviews

Initial research confirmed the product's failure. We rapidly pivoted toward Swiss homeowners, whose underserved need for complex financial planning presented a clear opportunity. We validated our assumptions through relentless experimentation and numerous prototypes, including:

- Life event calculators

- Google Ads campaigns

- A/B testing and more

Guided by the Kano Model, this led to a strategic pivot focused on providing users with a clear path to financial clarity.

+ 29% PMF Score Increase

This aggressive, user-focused strategy delivered outstanding results in just six months (May–December 2023). We achieved a +29% increase in PMF score, rising from 9% to a validated 38% for our primary target group of homeowners. This result successfully validated the new Digital Financial Advisor value proposition, immediately green-lighting the MVP feature set, which included a budgeting tool, a personalized dashboard, and asset and liability tracking.

MVP Liiva proposition

The validated MVP feature set was designed to empower immediate, actionable financial control. The Dashboard Hub provided a prospective financial overview, enabling users to track current and future expenses without complex data entry. Crucially, the 'Disposable Income' metric answered a core need for homeowners managing complex budgets: 'How much can I spend this month?' This focused, high-value feature set formed the prototype that rapidly confirmed Problem-Solution Fit and validated the FinTech pivot.

Joanna Hasse

Company: Liiva.ch

Industry: Fintech

From 9% to 38.0% PMF in Six Months

The first version of Liiva—a digital platform built to empower individuals in residential property search, management, and sales—faced a market failure, recording a low 9% Product-Market Fit (PMF) score. To survive, the business pivoted to become a Digital Financial Advisor, setting the core objective: Validate or refute our target group and value proposition.

The PMF Journey

With such high stakes, our phase-gated process was vital. It stopped us from chasing unvalidated ideas and prevented sunk costs by requiring concrete user proof at every stage of the pivot.

Lean experiments & research

23

Experiments

15

Prototypes

50

Interviews

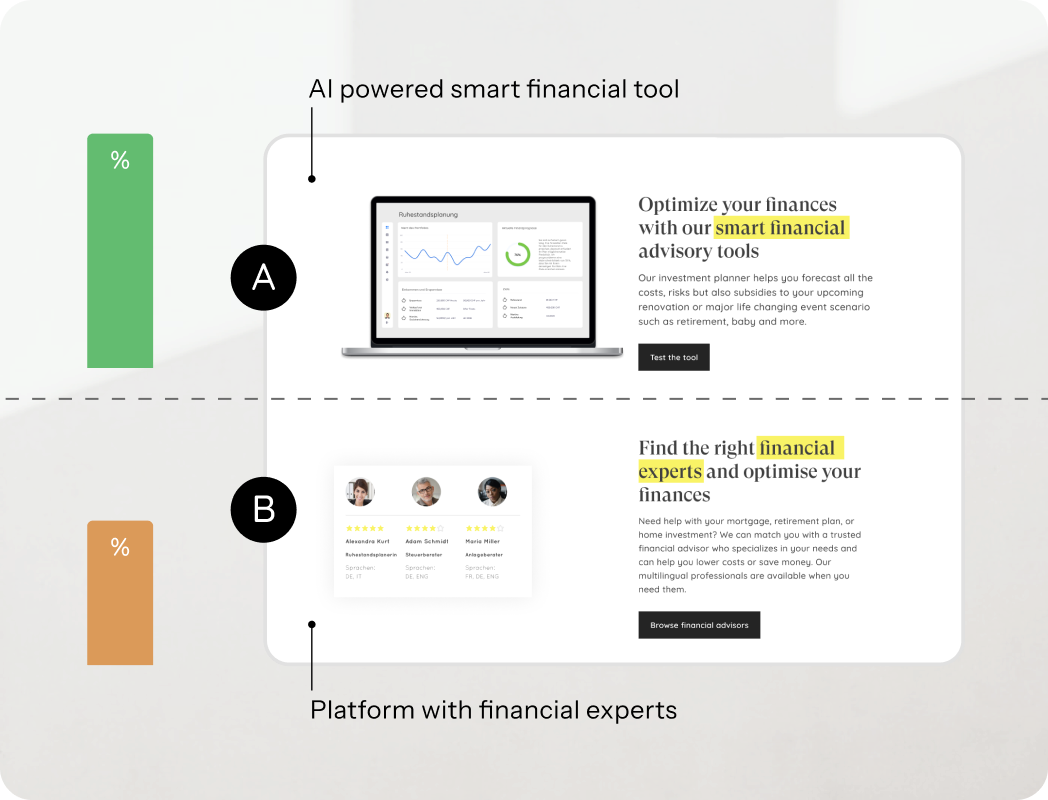

Initial research confirmed the product's failure. We rapidly pivoted toward Swiss homeowners, whose underserved need for complex financial planning presented a clear opportunity. We validated our assumptions through relentless experimentation and numerous prototypes, including:

- Life event calculators

- Google Ads campaigns

- A/B testing and more

Guided by the Kano Model, this led to a strategic pivot focused on providing users with a clear path to financial clarity.

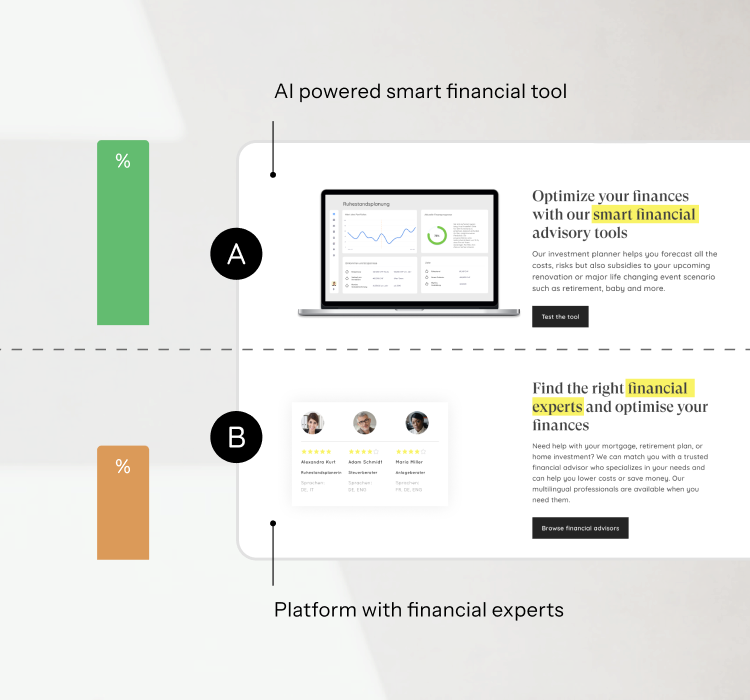

%

%

A

B

AI powered smart financial tool

Platform with financial experts

+ 29% PMF Score Increase

This aggressive, user-focused strategy delivered outstanding results in just six months (May–December 2023). We achieved a +29% increase in PMF score, rising from 9% to a validated 38% for our primary target group of homeowners. This result successfully validated the new Digital Financial Advisor value proposition, immediately green-lighting the MVP feature set, which included a budgeting tool, a personalized dashboard, and asset and liability tracking.

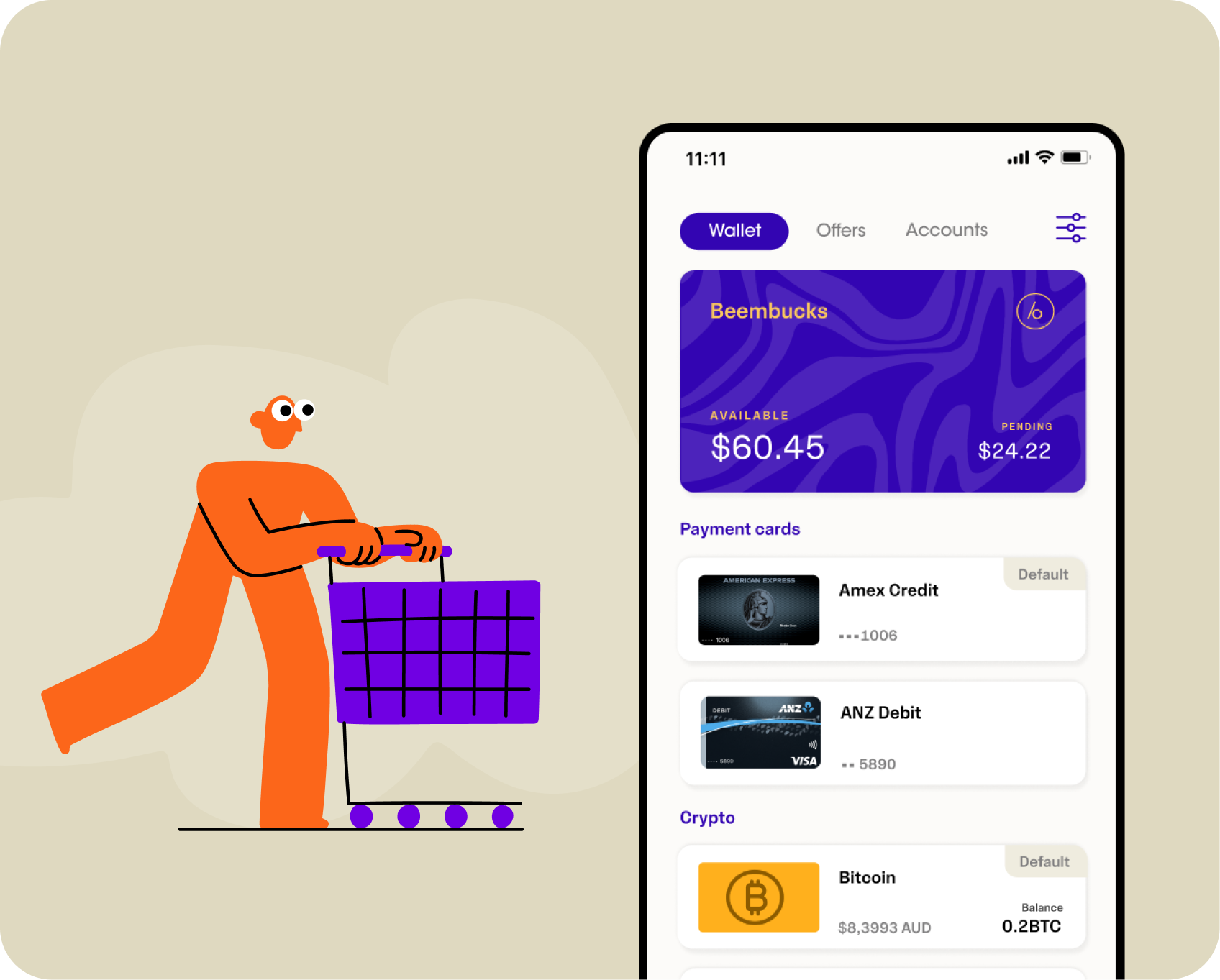

MVP Liiva proposition

The validated MVP feature set was designed to empower immediate, actionable financial control. The Dashboard Hub provided a prospective financial overview, enabling users to track current and future expenses without complex data entry. Crucially, the 'Disposable Income' metric answered a core need for homeowners managing complex budgets: 'How much can I spend this month?' This focused, high-value feature set formed the prototype that rapidly confirmed Problem-Solution Fit and validated the FinTech pivot.

Joanna Hasse

Company: Liiva.ch

Industry: Fintech

From 9% to 38.0% PMF in Six Months

The first version of Liiva—a digital platform built to empower individuals in residential property search, management, and sales—faced a market failure, recording a low 9% Product-Market Fit (PMF) score. To survive, the business pivoted to become a Digital Financial Advisor, setting the core objective: Validate or refute our target group and value proposition.

The PMF Journey

With such high stakes, our phase-gated process was vital. It stopped us from chasing unvalidated ideas and prevented sunk costs by requiring concrete user proof at every stage of the pivot.

Lean experiments & research

23

Experiments

15

Prototypes

50

Interviews

Initial research confirmed the product's failure. We rapidly pivoted toward Swiss homeowners, whose underserved need for complex financial planning presented a clear opportunity. We validated our assumptions through relentless experimentation and numerous prototypes, including:

- Life event calculators

- Google Ads campaigns

- A/B testing and more

Guided by the Kano Model, this led to a strategic pivot focused on providing users with a clear path to financial clarity.

+ 29% PMF Score Increase

This aggressive, user-focused strategy delivered outstanding results in just six months (May–December 2023). We achieved a +29% increase in PMF score, rising from 9% to a validated 38% for our primary target group of homeowners. This result successfully validated the new Digital Financial Advisor value proposition, immediately green-lighting the MVP feature set, which included a budgeting tool, a personalized dashboard, and asset and liability tracking.

MVP Liiva proposition

The validated MVP feature set was designed to empower immediate, actionable financial control. The Dashboard Hub provided a prospective financial overview, enabling users to track current and future expenses without complex data entry. Crucially, the 'Disposable Income' metric answered a core need for homeowners managing complex budgets: 'How much can I spend this month?' This focused, high-value feature set formed the prototype that rapidly confirmed Problem-Solution Fit and validated the FinTech pivot.

Joanna Hasse